Investors

Our app is set to transform the dining experience, but we need your support to bring it to life. We're dedicated and hard at work, but to make this vision a reality, we need the right team and resources.

OVER 140K RAISED

|

20+ EARLY USERS

|

300+% YoY WEBSITE TRAFFIC

OVER 140K RAISED | 20+ EARLY USERS | 300+% YoY WEBSITE TRAFFIC

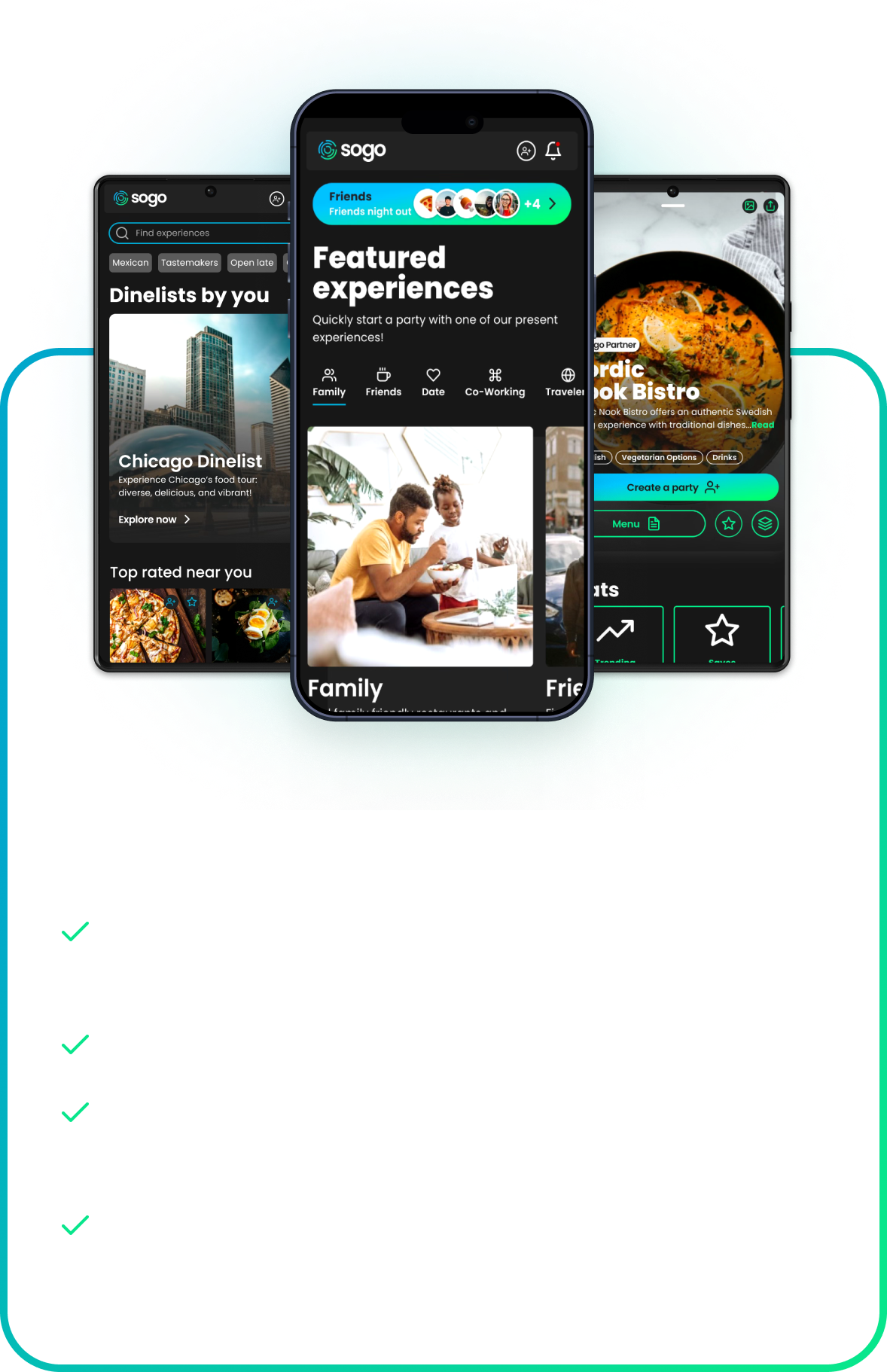

Consumers need smarter matches, not more choices.

Other apps bury you in stars, SEO bait, and review chaos. We serve curated recs built around you—your tastes, your people, your values. SoGo isn’t about endless options. It’s about the right one.

Positioning

Lorem ipsum dolor sit amet consecte tur adipiscing elit semper dalaracc lacus vel facilisis. Lorem ipsum dolor sit amet consecte tur adipiscing elit semper dalaracc lacus vel facilisis.

Industry Insights

Massive and Growing Market

The global restaurant industry is projected to exceed $1 trillion by 2025, with a significant portion driven by consumers seeking convenient and personalized dining solutions. Our industry is evergreen.

High Consumer Engagement

Over 80% of diners rely on digital tools for restaurant discovery, presenting a significant opportunity to capture a tech-savvy audience.

Targeted Reach Potential

Our initial focus on three key geographic areas: Chicago, SE Michigan, and Charlotte represents over 6MM TAM, with scalability to broader markets as we expand features and partnerships.

*Data as of 2023. Information used for illustrative market purposes

Our Results

Injected ~$135K into the business to date

2023

Angel Investment

Established C-corporation in Deleware to help add structure to the idea and set the stage for next steps.

2024

Bootstrapping

Founder bootstrapping initiatives continued our advance towards our goals allowing for significant achievement in development milestones.

2024+

2024 and Beyond

Some Good People’s leaders actively attend networking and investor events to advance our capital raise goals. Efforts like engaging with Lofty Ventures, applying to Y-Combinator, and pursuing small business grants reflect our dedication to building valuable connections within the investment community.

DRIVE INNOVATION

How Do I Invest

To learn more about our vision and how you can contribute to our success, please reach out via the form on this page. Our team is eager to connect with you, discuss your investment goals, and provide detailed information about our business model and growth potential. Join us in shaping the future of restaurant recommendations and be part of a venture that is poised for success!

We are 'testing the waters' to gauge investor interest in an offering under Regulation Crowdfunding. No money or other consideration is being solicited. If sent, it will not be accepted. No offer to buy securities will be accepted. No part of the purchase price will be received until a Form C is filed and only through WeFunder’s platform. Any indication of interest involves no obligation or commitment of any kind.

Accredited Investment Opportunities are available only to individuals or entities that meet the SEC’s definition of an accredited investor. This typically includes individuals with an annual income of over $200,000 ($300,000 with a spouse) or a net worth exceeding $1 million, excluding their primary residence. Please consult with a financial advisor or legal professional to determine your eligibility.

Frequently Asked Questions

Our FAQ section is here to provide quick answers to the most common questions about our app and services.

-

Need copy

-

Need copy

-

Need copy

-

Need copy

Bring SoGo to Your Table - Plenty of Seats Await

INTERESTED IN INVESTING WITH US

Ready to take the next step in your investment journey? Contact us today to learn more about the opportunities we offer and how they align with your financial goals. Our team is here to provide you with all the details you need to make an informed decision!

Risks of Early-Stage Investments

Investing in an early-stage startup involves a high degree of risk, and prospective investors should carefully consider these risks before making any investment decisions. There is no guarantee that the company will achieve its goals or generate returns on investment. Key risks include, but are not limited to:

Market Risks: The product may fail to gain traction, face unforeseen competition, or experience changes in consumer behavior.

Operational Risks: The company is in the early stages of development, with evolving business models and operational challenges that may impact growth and sustainability.

Financial Risks: Early-stage companies often rely on external funding and may not generate significant revenue in the short term, leading to potential financial instability.

Regulatory Risks: Changes in laws, regulations, or industry standards could materially impact the company’s operations or marketability.